Quickbooks paycheck calculator

Ad Award-Winning ERP Accounting Business Software From NetSuite. Some states follow the federal tax.

Solved How To Fix Payroll Error In Quickbooks Desktop

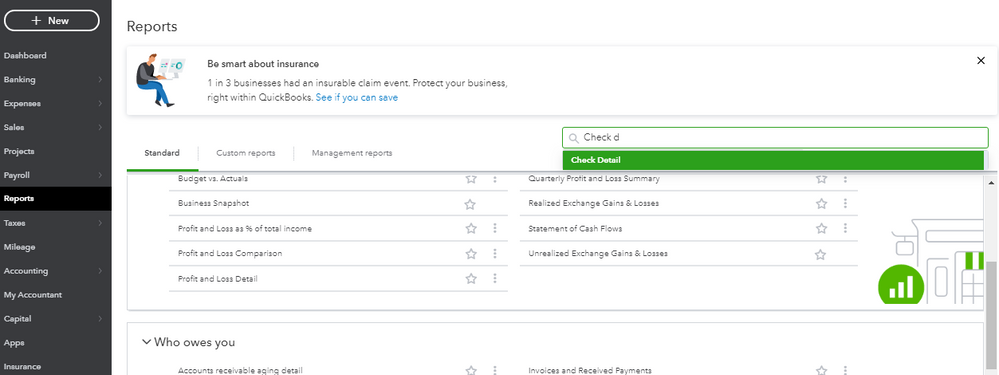

One of those tabs free paycheck calculator intuit is the Accounts menu where you can find and alter checks bank accounts and expense claims and create records for your payroll needs.

. It is a very simple process. Get 3 Months Free Payroll. Gusto can streamline and handle employment tax reporting payments workers comp insurance new hire reports and detailed budget plans.

Small Business Low-Priced Payroll Service. 2022 Intuit Inc. How to Calculate Payroll for Employee We live in times of flexibility and constant change hence the question of how to calculate.

Once you have these numbers. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Get 3 Months Free Payroll.

UsingPOS Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. Ad Award-Winning ERP Accounting Business Software From NetSuite. It helps you to calculate paychecks for hourly or salary employees with quality output.

Then enter the number of hours worked and the employees hourly rate. Starting as Low as 6Month. Ad QuickBooks Automatically Calculates Federal State Payroll Taxes.

Get A Free Product Tour. Estimate your paycheck withholding with our free W-4 Withholding Calculator. After taking into account your profession your market and your personal skills and experience dont forget to look at your costs of doing business.

We use the most recent and accurate information. Get an accurate picture of the employees gross pay including. Fast Easy Affordable Small Business Payroll By ADP.

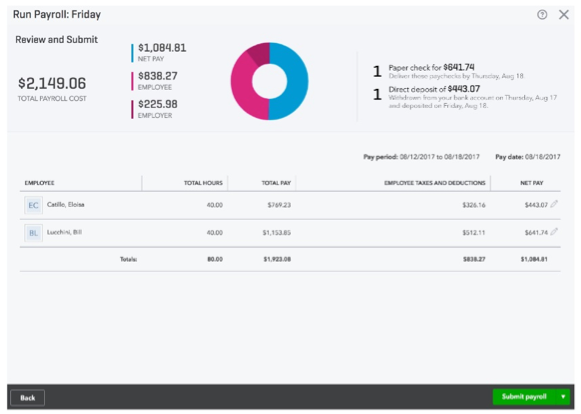

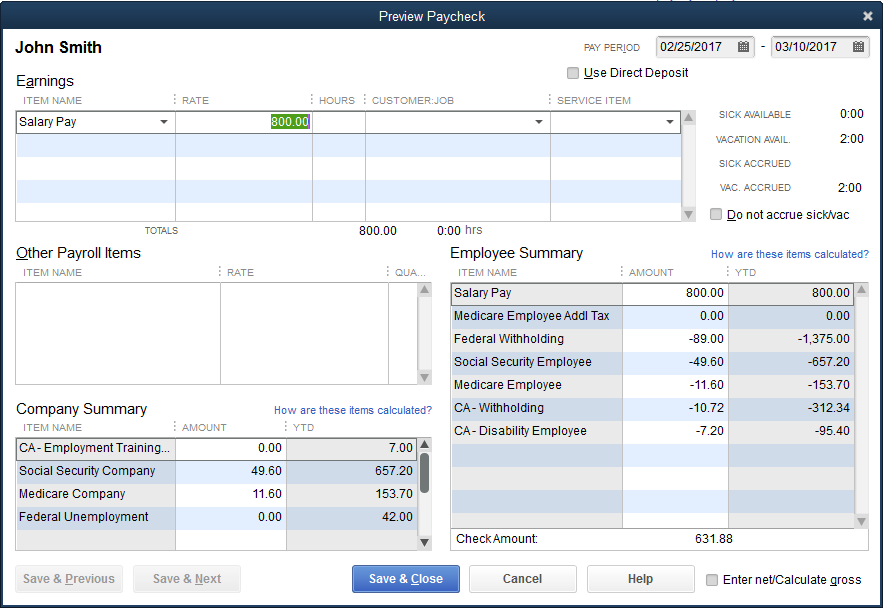

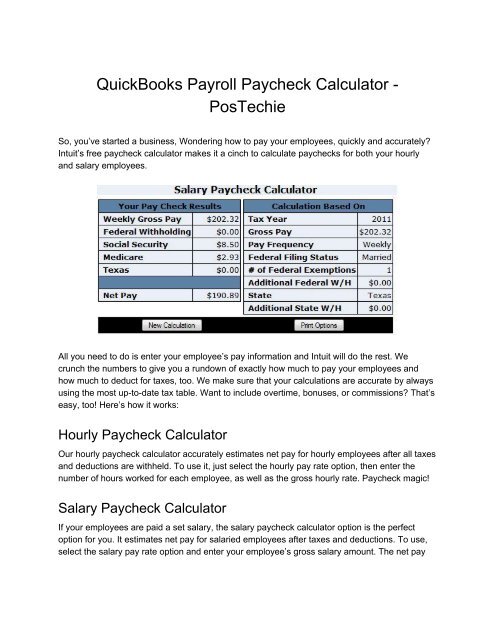

QuickBooks Payroll is just open through QuickBooks Online memberships. Ad QuickBooks Automatically Calculates Federal State Payroll Taxes. The QuickBooks Paycheck Calculator calculates net pay for salaried and hourly employees factoring in bonuses commissions and overtime worked.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Terms and conditions features support pricing. Essentially back pay is the term for wages that are.

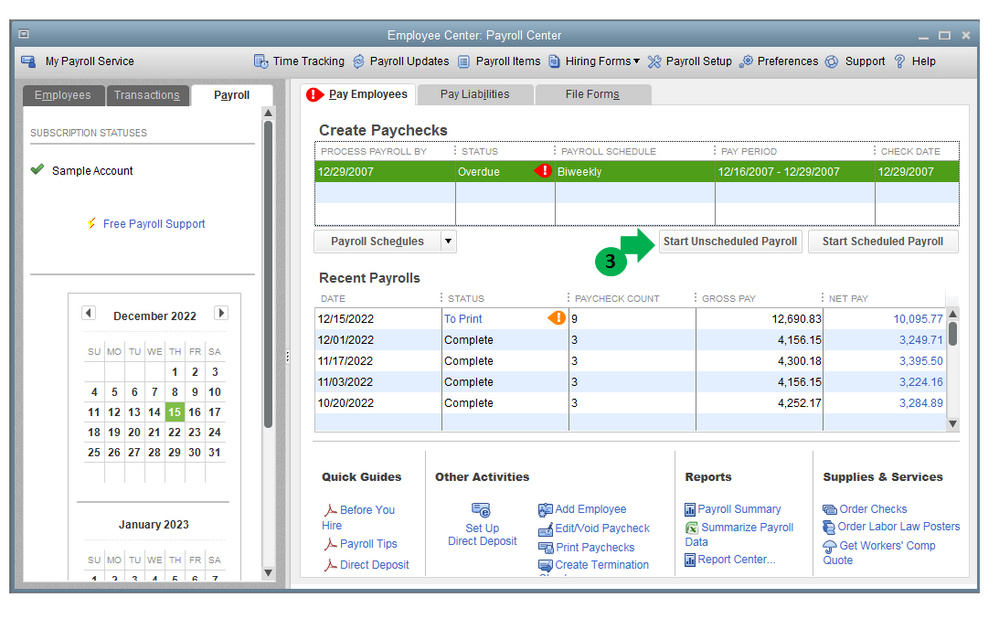

Heres a step-by-step guide to walk you through. Get A Free Product Tour. 2K views 19 likes 3 loves 12 comments 10 shares Facebook Watch Videos from Intuit QuickBooks.

QuickBooks Payroll Calculator is a free calculator designed by Intuit. In case you want to get more detailed information on QuickBooks Payroll calculators you can contact QuickBooks Payroll calculator Support. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

OBTP B13696 2018 HRB Tax Group Inc. Based on up to eight different hourly. It also allows you to easily set up and manage 401.

3 Months Free Trial. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option. Use QuickBooks free paycheck calculator to pay every one of your representatives whether you.

Ad Create professional looking paystubs. Ad Compare 5 Best Payroll Services Find the Best Rates. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

Intuit and QuickBooks Workforce are registered trademarks of Intuit Inc. Once employees are set free paycheck calculator. Make Your Payroll Effortless and Focus on What really Matters.

Ad Learn How To Make Payroll Checks With ADP Payroll. Back pay can be defined as the difference between the amount of pay a worker is owed versus what they actually received. The state tax year is also 12 months but it differs from state to state.

You may have incorrectly typed the address URL or clicked on an outdated link. Save 60 off your first order of custom business checks. Get 3 Months Free Payroll.

DidYouKnow you can calculate hourly and salaried employee paychecks in. Get 3 Months Free Payroll. Generate your paystubs online in a few steps and have them emailed to you right away.

Fast Easy Affordable Small Business Payroll By ADP. Ad Order business checks forms deposit slips and other essential supplies for your office. Ad Learn How To Make Payroll Checks With ADP Payroll.

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

One Day Processing Now Available For Quickbooks Payroll Quickbooks

Desktop Payroll Taxes Suddenly Not Deducted

Solved Payroll Taxes Not Deducted Suddenly

Why Is Quickbooks Not Calculating Salary Pay Based On Peap Year For 2020

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Solved Recording Payroll Payments

Quickbooks Payroll Is Not Taking Out Calculating Taxes Fixed

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Solved Payroll Taxes Not Deducted Suddenly

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

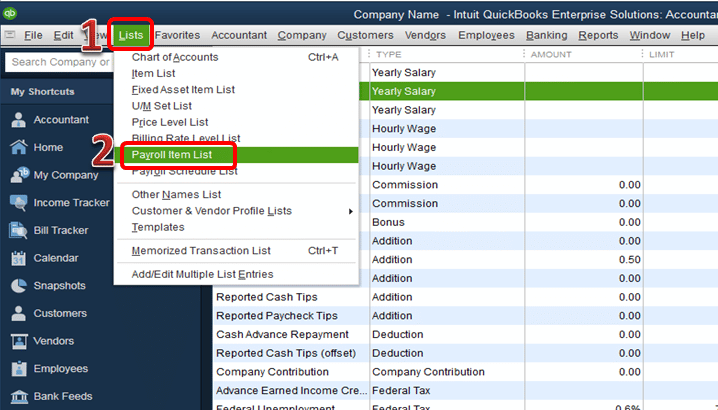

Manually Enter Payroll Paychecks In Quickbooks Online

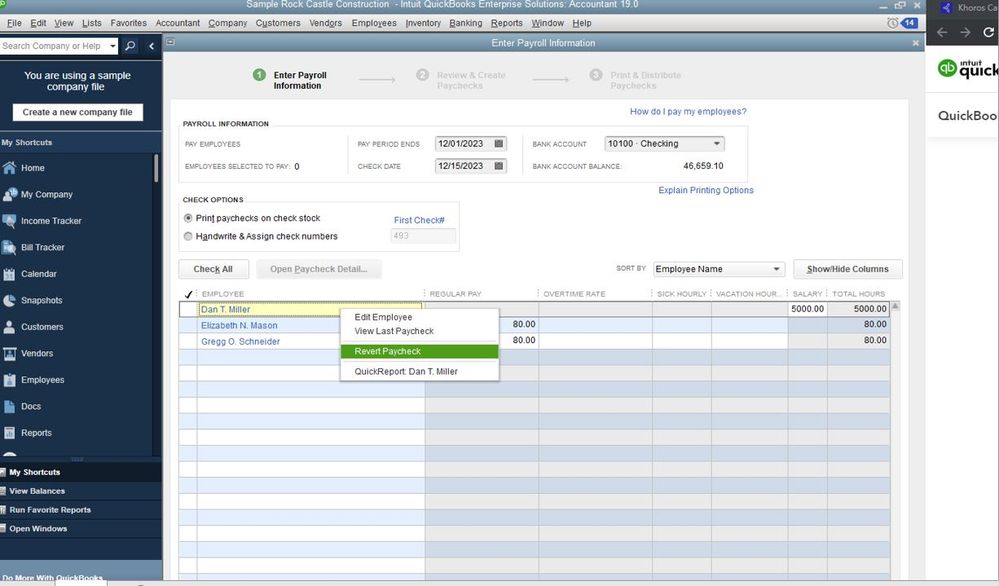

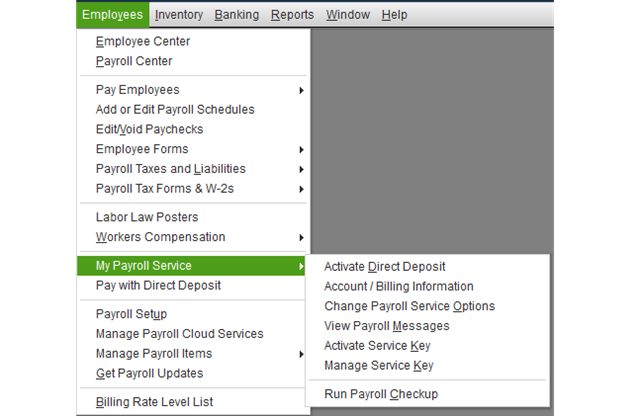

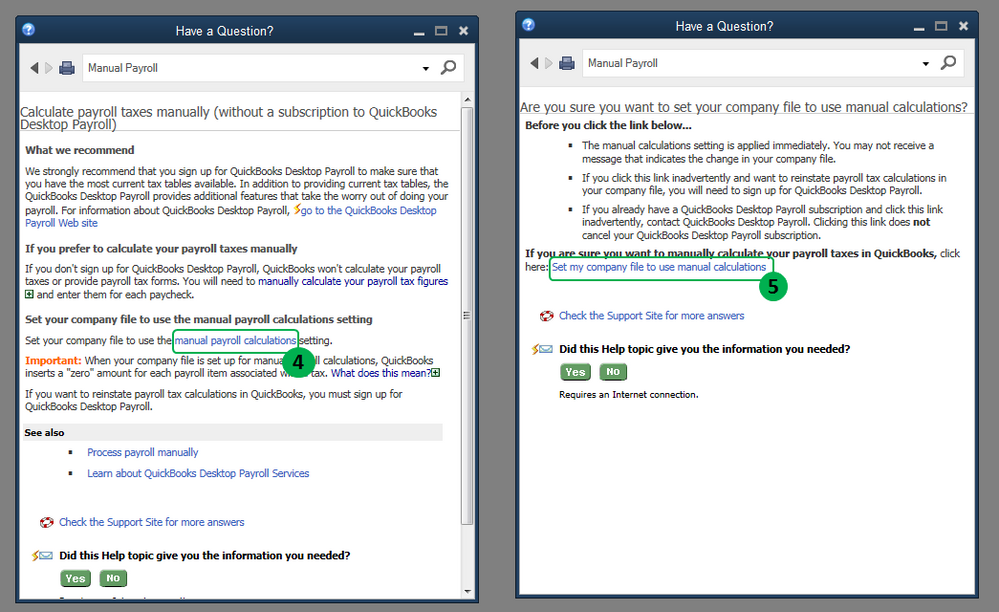

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

Calculating Manual Payroll Option Is Not Available

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Solved Payroll Taxes Not Deducted Correctly