17+ dti for mortgage

Compare More Than Just Rates. That means if you earn 5000 in monthly gross income your total debt obligations should be.

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

Many lenders require a DTI.

. Compare Offers Side by Side with LendingTree. Your DTI is 378. Web How to calculate your debt-to-income ratio.

Web Since the January 2023 announcement FHFA has received feedback from mortgage industry stakeholders about the operational challenges of implementing the. This includes cumulative debt payments so think credit card payments. Monthly mortgage or rent payment minimum.

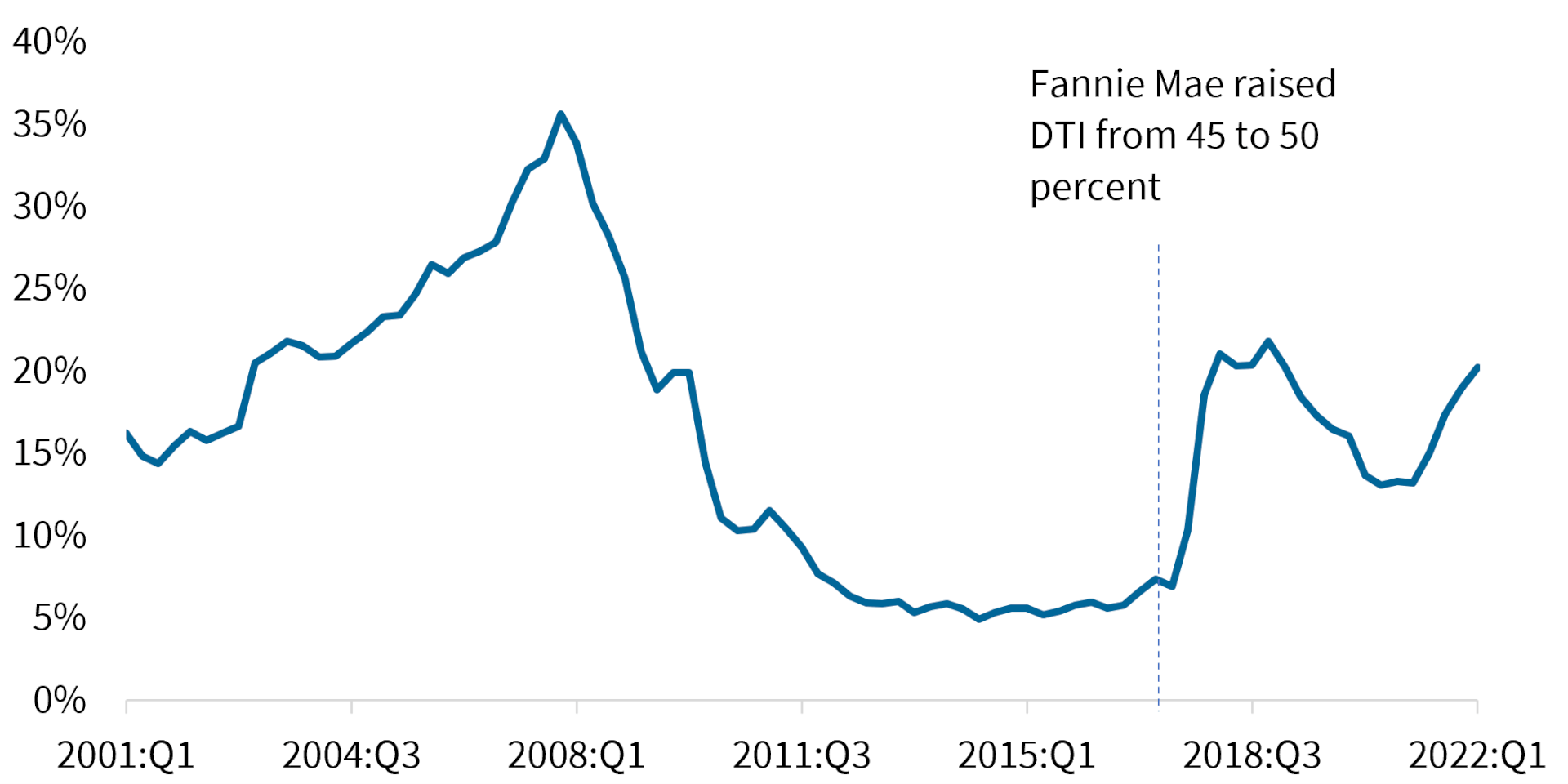

Web 2 days ago15-year fixed-rate mortgages. Web The Federal Housing Finance Agency has pushed back the implementation date of some of the adjusted fees set to apply to mortgages purchased by Fannie Mae. Web To calculate your DTI add the expenses together to get 1700.

Web FHA loans. To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments. Web After the lending industry came out in full force against new upfront loan fees based on borrowers debt-to-income DTI ratios the Federal Housing Finance Agency.

Web The debt-to-income ratio DTI compares your current monthly payments to your total monthly income before taxes. Get the Right Housing Loan for Your Needs. Apply Easily Get Pre Approved In 24hrs.

Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house. Rules differ by lender but most. Web In general lenders prefer that your back-end ratio not exceed 36.

Web When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified income and debt amounts and the result may differ from the one shown here. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. These payments may include.

Find A Lender That Offers Great Service. Ad Best Housing Loans Compared Reviewed. A DTI of 43 is typically the highest.

Youll usually need a back-end DTI ratio of 43 or less. Web Heres a simple two-step formula for calculating your DTI ratio. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison.

This calculator is for educational purposes only and is not a denial or approval of credit. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. You May Get Up to 10K Toward Your Down Payment.

Web 2 days agoThe DTI can fluctuate throughout the mortgage application and underwriting process and the FHFAs new fees will inevitably lead to borrowers costs changing. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Then divide 1700 by 4500 which equals 378.

Ad Feel The Pride of Becoming a Homeowner. Web Lenders use your debt-to-income DTI ratio to assess whether you can afford the monthly payments on the mortgage youre applying for. Web How to Calculate Debt-to-Income Ratio.

Add up all of your monthly debts. Some lenders may accept a debt-to-income ratio of. Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. When you apply for credit your lender may calculate your debt-to-income DTI ratio. Find A Lender That Offers Great Service.

The average rate for a 15-year fixed mortgage is 622 which is a decrease of 11 basis points compared to a week ago. Compare More Than Just Rates. Two types of calculations are employed in mortgage.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. Ad Explore Quotes from Top Lenders All in One Place. Begin Your Loan Search Right Here.

Web DTI measures your debts as a percentage of your income. If your home is highly energy-efficient and you have a high credit score you may be able to.

Michelle Pickett Senior Mortgage Banker At Atlantic Bay Mortgage Group Charlottesville Va

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

How Do I Remove The Pmi On My Fha Loan

Mortgage How Much Can You Borrow Wells Fargo

Nmp National Mortgage Professional July 2022 By Ambizmedia Issuu

Mortgage Credit Availability Projected To Rise Due To Weakening Demand Dsnews

Debt To Income Ratio Calculator What Is My Dti Zillow

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx

Jtl6gez7cboyqm

O6fqnj55d6 76m

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio What Is A Good Dti For A Mortgage

Ad Mortgage Loans A D Mortgage Llc